The Congressional Budget Office (CBO) released an update to its recurring report, The Budget and Economic Outlook, which shows a somewhat rosier budgetary picture over the next ten years than the most recent iteration of the report showed. The rosier budgetary picture is almost entirely because of a supposedly better economic climate and assumed low interest rates. Obviously, that could change.

The previous iteration of the report published in September 2020 showed that the federal government would run budget deficits in excess of $1 trillion for the next ten years. However, the new report shows higher projections for revenues, although outlays will continue to do grow. At the outset, it’s important to note that the report reflects current law as of January 21 and isn’t predictive of what Congress may do.

One of the more interesting aspects of the report is that gross domestic product (GDP), which is the total value of goods and services, is projected to be lower than the projections found in the September 2020 report. For example, the CBO expects GDP to be $1.132 trillion lower in fiscal year (FY) 2021 than projected in September. In FY 2030, GDP is $1.183 lower than previously projected.

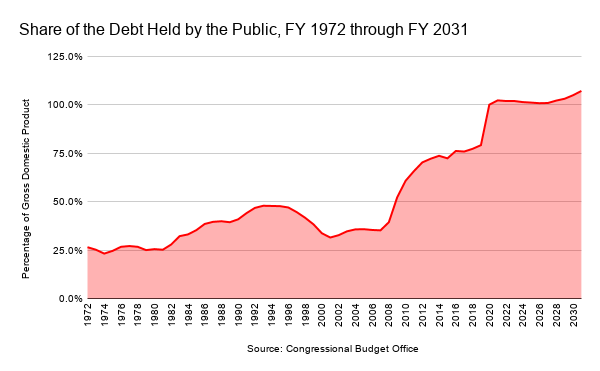

Additionally, the projections for the share of the national debt held by the public are lower than previously thought, coming in at $2 trillion less in FY 2030 than the September projection. Still, the share of the debt held by the public is projected to come in at $35.3 trillion, or 107.2 percent of GDP. In FY 2021, the share of the debt held by the public is projected to be $21.9 trillion, or 102.3 percent of GDP.

Some may say that this is lower than the national debt that we often see in op-eds from conservative political pundits and fiscal hawks. That’s because those pundits use a figure that includes intergovernmental holdings. This is money that the federal government owes itself. Intragovernmental debt occurs when the federal government borrows from trust funds. Unlike most public debt, almost all intergovernmental debt isn’t marketable.

Now, some could read that and say, “Aha! Congress raided the Social Security trust funds and spent the money!” No, that’s not what happened. Surplus revenues into the trust funds were invested by the Department of the Treasury into government-issued securities. Anyway, back to the main point.

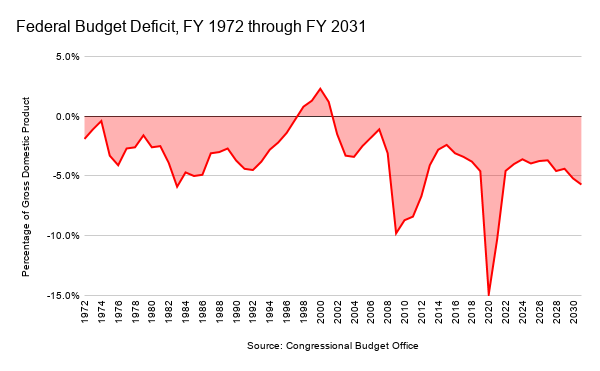

In FY 2020, Congress ran a budget deficit of $3.132 trillion, or 14.9 percent of GDP. This was the largest budget deficit that the federal government has run since 1945, the year in which World War II ended. In a more recent context, the budget deficit at the height of the Great Recession was 9.8 percent of GDP.

The budget deficit is projected to gradually decline based on current law. In FY 2021, the budget deficit is projected to be $2.2 trillion, or 10.3 percent of GDP. (More on FY 2021 in a moment.) The budget deficit is projected to continue to fall, dropping below $1 trillion in FY 2023 and FY 2024, before rising again. By the end of the ten-year budget winder, in 2031, the budget is projected to come in just below $1.9 trillion, or 5.7 percent of GDP.

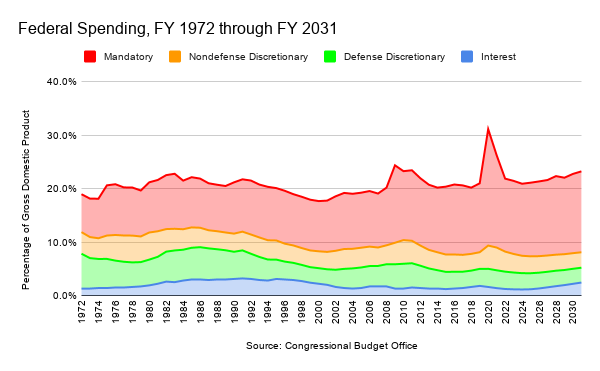

Mandatory spending is driving budget deficits. Between FY 1962 and FY 2019, federal spending averaged 20.1 percent of GDP, but that is going up. This was also the case before COVID-19 reached the United States. Mandatory spending has grown from 7.1 percent of GDP in FY 1972 to 12.9 percent in FY 2019. In FY 2031, mandatory spending is projected to be 15.1 percent of GDP. By 2031, federal spending is projected to be 23.2 percent of GDP. Although the CBO hasn’t updated its long-term budget outlook since September, it projected that federal spending would be 31.2 percent of GDP.

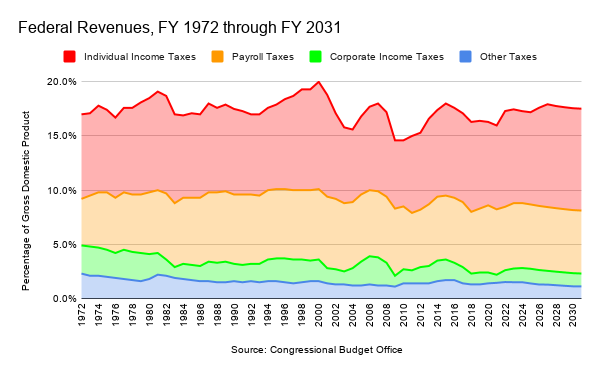

Of course, revenues dropped because of the pandemic. Using the same historical measure used for spending, federal revenues averaged 17.3 percent of GDP. In FY 2019, individual income tax revenues as a percentage of GDP were fairly close to where they were in previous years, coming in at 8.1 percent of GDP compared to 8.5 percent of GDP in FY 2015. Revenues, however, are expected to rise once the individual income tax cuts and reforms under the Tax Cuts and Jobs Act expire at the end of tax year 2025, which occurs during FY 2026.

Back to FY 2021. As mentioned, the CBO bases its projections off of current law as of January 21 and doesn’t take into account the budget resolutions passed in early February by the House and Senate and pending reconciliation legislation that adds to the budget deficit by approximately $1.9 trillion over the next ten years.

The CBO has scored the reconciliation recommendations of only six committees. Those six committees’ reconciliation legislation increase the budget deficit by $166 billion in FY 2021 and $370 billion through FY 2030, so not all the spending is frontloaded to FY 2021, although most of it is. For example, in the Energy and Commerce reconciliation recommendations, about half of the spending takes place in FY 2022 alone. More than 70 percent of the spending from the Energy and Commerce recommendations happens in FY 2021 and FY 2022.

CBO Cost Estimates of Pending Reconciliation Recommendations from House Committees (Dollars in Millions)

| Committee | 2021 Outlays | 2021-2030 Outlays | 2021-2030 Deficit Impact |

|---|---|---|---|

| Agriculture | $13,018 | $16,072 | $16,072 |

| Education and Labor | Not Yet Scored | Not Yet Scored | Not Yet Scored |

| Energy and Commerce | $27,498 | $126,130 | $124,656 |

| Financial Services | $38,189 | $72,880 | $72,880 |

| Foreign Affairs | Not Yet Scored | Not Yet Scored | Not Yet Scored |

| Natural Resources | Not Yet Scored | Not Yet Scored | Not Yet Scored |

| Oversight and Reform | Not Yet Scored | Not Yet Scored | Not Yet Scored |

| Science, Space, and Technology | Not Yet Scored | Not Yet Scored | Not Yet Scored |

| Small Business | $48,400 | $49,790 | $49,790 |

| Transportation and Infrastructure | $28,400 | $90,460 | $90,460 |

| Veterans’ Affairs | $10,720 | $16,612 | $16,612 |

| Ways and Means | Not Yet Scored | Not Yet Scored | Not Yet Scored |

| TOTAL | $166,225 | $371,944 | $370,470 |

Considering that the budget reconciliation recommendations, which will soon be turned into a single bill by the House Budget Committee for consideration later this month, the CBO’s budget projections aren’t really worth much. The CBO also makes an assumption that interest rates will remain relatively low. When interest rates begin to rise, the cost of servicing the debt will also begin to rise. That means federal spending will also rise, increasing budget deficits. That’s not sustainable over the long-term because, eventually, those buying our debt will begin to question whether or not we can pay it back.